The current Accounting and Budget Department, King Chulalongkorn Memorial Hospital, the Thai Red Cross Society, is located on 13th Floor of the 3-storey car park building. It plays an important role in managing resources to be useful and in accordance with the hospital strategy. It also manages budget planning, disbursement document control and accounting issues for the hospital. The department also arranges meetings, training to provide knowledge about assets, regulations and disbursement to various departments in the hospital.

Obligation

The Department is determined to be an efficient supporting unit to ensure that the executives receive accurate and precise financial data for more effective management of the Hospital, etc.

Support Activities

- Promote efficient and effective budgeting processes and management.

- Implement a disbursement process that is correct, transparent, accountable, timely and compliant with the rules, regulations, and policies of the Thai Red Cross Society.

- Prepare accurate and precise financial statements within the prescribed time period and in compliance with the accounting standards and the generally accepted accounting principles.

- Prepare efficient financial analysis reports for the operational planning, performance evaluation and to supplement the executives’ decision making.

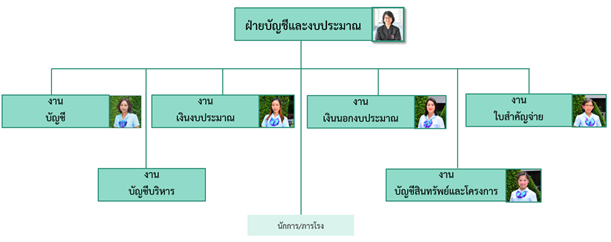

Accounting and budget department structure Divide duties and responsibilities into 6 departments

Responsibility

1. Accounting unit.

- Verify the submission documents for all types of revenue from the hospital by the finance department sent to the treasury office, ensuring the accuracy of account codes and fund codes, and confirm the accounting entries in the FMIS system.

- Record accounts receivable for medical expenses from the HIS system into the FMIS system for all sources, and prepare a control register for outstanding receivables by group. At the end of each year, calculate and set aside a provision for doubtful debts.

- Verify and record donations accounted for by other departments, such as the Fundraising Office.

- Verify expenses and account pairs from supporting documents for both budgeted and non-budgeted funds and confirm the entries in the FMIS system (except for repairs of fixed assets). Prepare a control register for outstanding creditors.

- Record inter-office and external fund transfers through inter-debtor accounts, summarizing the outstanding inter-debtor balances for reconciliation with different offices for all funds.

- Record the opening of rights for benefactors in the HIS system for cases where rights have not been previously opened to provide discounts on medical expenses.

- Verify and record the setup of advance loan receivables in the FMIS system for both blue and yellow forms, and prepare a monthly control register.

- Verify and record the income and expenses of funds according to various objectives, including general funds, specific funds, and fund earnings, ensuring they match with the general ledger and control registers.

- Control short-term guarantee funds, send them to the procurement/contracting department, record them in the FMIS system, and record the release of guarantee funds in the control register, ensuring it matches the general ledger.

- Review the overall financial statements and sub-funds, and reconcile them accurately before closing the financial statements.

- Prepare cash-basis income and expense data for all Thai Red Cross Society deposit funds.

- Verify the register against the general ledger for each task, and submit it to the treasury office every month (monthly financial report) by the 15th of the following month.

2. Budgetary Funds Management

- Prepare the annual budget and request financial support from the government.

- Monitor and control the use of the budget.

- Prepare a report on budget spending to the Finance Office and the Office of Policy and Strategy.

- Review and prepare advance payment vouchers and manage the disbursement and repayment of advance payments.

- Prepare reports on funds carried forward to the next fiscal year.

- Record the source of funds, classify the budget type, and specify the account code according to the Purchase/Contract Request (PR) and Purchase/Contract Approval (PA) in the FMIS system.

- Prepare the budget disbursement approval voucher and summary payment notification.

- Expedite the execution of the operational plan and budget expenditure plan efficiently.

- Review/control the use of the central budget, Thai Red Cross budget, research support budget, and medical welfare funds.

3. Off-Budget Funds

- Prepare the budget for revolving funds, control the accounts of income and expenses for off-budget funds.

- Oversee donations, deposits, revolving funds, and hospital funds.

- Analyze and allocate off-budget funds for the hospital’s procurement activities.

- Record off-budget fund disbursements in the FMIS system.

- Prepare disbursement approval vouchers and summary payment notifications for off-budget funds.

- Record advance payment loans (blue and yellow loan forms in the FMIS system) and manage the disbursement and repayment of advance payment loans.

- Prepare documents to request approval for the purchase of medical equipment with depreciation funds and present them to the National Health Security Office.

- Request approval to open/close and change the names of off-budget fund sources.

- Record the transfer of revolving funds for the purchase of medical equipment and present them to the treasurer of the Thai Red Cross Society.

- Adjust incorrect entries of revenue budget increases and decreases.

- Open/close and change the authorized signatories of the bank accounts for the department and the central hospital.

4. Payment Vouchers

- Review disbursement documents for all sources of funds (budgetary and off-budget).

- Verify the documents for fund transfers from all sources (budgetary and off-budget) within and between offices.

- Provide consultation and guidance on the regulations for various types of disbursements.

- Review the completeness of receipts and vouchers, create control registers before disbursement, and check copies of used receipts; maintain a control register for receipt usage.

- Verify copies of used receipts and maintain a control register for receipt usage.

- Handle requests and locate lost receipts.

- Manage documentation and maintain records for the accounting and budget department.

5. Management Accounting

- Manage the month-end closing process for Chulalongkorn Hospital on a monthly, quarterly, and annual basis to ensure the completeness, accuracy, and timeliness of financial statements.

- Prepare financial reports for the hospital in compliance with referenced accounting standards and the accounting policies of the Thai Red Cross Society.

- Create managerial financial reports, including analysis of performance and financial position, to assist management and the hospital board in planning, controlling, and evaluating operations and making decisions.

- Prepare financial reports and data for other hospital units, such as revenue and expense statements for revolving funds, special clinics, etc., to enable effective and timely management and decision-making.

- Compile annual reports on the allocation of surplus revenue from revolving funds and after-hours special clinics (outpatient special clinics, special service clinics).

- Analyze costs for the performance of various departments, such as the Department of Nutrition, among others.

- Prepare accounting data for management presentations in PowerPoint format.

6. Asset and Project Accounting

- Verify the recording of asset transactions, including acquisition, disposal, transfer, lending, depreciation calculation, and amortization.

- Review the recording of inventory (stock) accounting.

- Inspect the accounting records for expenses related to the repair and maintenance of equipment/buildings and the maintenance contracts (MA) for hardware, software, and network.

- Check the accounting for work-in-progress assets and ensure the timely registration of assets to accurately calculate depreciation in financial reports.

- Oversee the process of asset and inventory stock counting to ensure accuracy and completeness in alignment with the actual situation.

- Control the end-of-period closing process for asset accounting, ensuring completion within the specified timeframe.

- Compile and prepare reports as supporting details for financial statements and to facilitate financial analysis.

- Prepare data for asset insurance purposes.

Identity

We will take responsibility for our mission,

Following the compass, aiming towards our goals.

Prioritize according to policy,

Innovating in diverse ways, to stay timely.

Work with a public-minded spirit,

Serving all citizens, every class.

Caring and supporting one another,

Valuing the importance of our colleagues.

The key to practice,

Is to be honest and upright by nature,

Follow the plan, adhere to discipline,

Never use the work for personal gain.

We will work together to fulfill our mission,

Turning crises into opportunities,

So that both giver and receiver feel comforted,

Under the hospital’s principles of virtue.